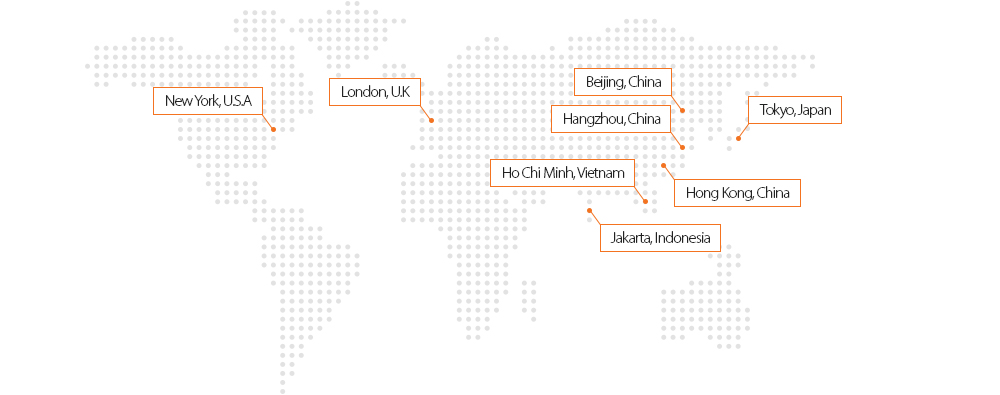

Global Management

VIETNAM

VIETNAM Overseas Affiliates

HLI became the first Korean life insurer to enter the market in Vietnam in 2008. After establishing a local affiliate we commenced a full-scale operation in 2009. By 2015, the seventh year of full operation, Hanwha Insurance Vietnam had built 54 sales networks with more than 12,000 agents and recorded a total first premium receipt of USD 14.01 million thanks to strong sales endeavors, laying the foundation for a sustainable growth. All the while, our Vietnamese affiliate is conducting diverse community contributions and outreach activities. The entire workforce participates in the company’s annual blood donation campaign and volunteer in hospitals, and in 2015, Hanwha Insurance Vietnam carried out various campaigns such as delivering health insurance cards, and building home for underprivileged families and health centers.

CHINA

CHINA Overseas Affiliates

Hanwha Life opened a representative office in Beijing in August, 2003, and had been planning to enter the Chinese insurance market since then. These efforts resulted in establishment of a joint venture life insurance company, Sino-Korea Life Insurance Co., Ltd., in 2012 with Zhejiang International Business Group, one of the 500 largest Chinese companies, and the joint venture went into operation in 2013. Based on strict localization and multichannel strategies, Sino-Korea Life Insurance is expanding its presence and partnership for bancassurance in major cities of Zhejiang Province. At the same time, the joint venture is conducting diverse social contribution activities, demonstrating its commitment to the prosperity of the local community. In 2015, Sino-Korea Life Insurance reported a total first premium receipt of USD 53.64 million, a whopping 89% increase compared to that of the last year, demonstrating HLI’s successful arrival in the life insurance market in Zhejiang, with the second-highest record in terms of new contract premiums among foreign life insurers operating in Zhejiang. Sino- Korea Life Insurance will continue to expand its sales network and scope of business with an emphasis on bancassurance, enhance the agency channel productivity, and diversify the product portfolio to lay a sustainable foundation on which to make inroads into other Chinese markets including Jiangsu Province beyond Zhejiang Province.

INDONESIA

INDONESIA Overseas Affiliates

In 2012, HLI successfully entered Indonesia, a country with the world’s fourth largest population, through the acquisition of a local life insurer, and it was the first international takeover by a Korean life insurer. Since HLI began official operation in October 2013, we have established multi-channels for sales and achieved USD 5 million in initial premium in 2015, a whopping 5.6-fold increase year on year. Hanwha Life Insurance Indonesia is set to pass on 60 years’ know-how of the headquarters in Korea to local businesses and is planning to expand the operational base in major cities including Java Island to reflect the needs of the Indonesian market.

JAPAN

JAPAN Representative Offices

The Japanese insurance market is similar to the Korean insurance market in many aspects including related laws and systems, population structure, and insurance products. HLI opened a representative office in Tokyo in 2005 and has since analyzed the Japanese insurance market to predict changes in the Korean market through Japanese examples and has been collecting data and providing the analysis for reference to conduct better business judgement. Hanwha Life Tokyo provides supports for alternative investment to locate new opportunities and tracks the trends of Fintech in Japan.

U.S.A

U.S.A Representative Offices

U.S.A. HLI set up a US affiliate and a representative office in New York to provide efficient asset management and analysis of global insurance market trends. The US affiliate is responsible for managing HLI’s global assets and has made a considerable contribution in raising our asset management returns since founded in 2005. The New York representative office, opened in 2007, conducts research on the US insurance market and analyzes trends of the global insurance industry, enabling HLI to respond swiftly to market environment changes and varying customer needs.

U.K

U.K Representative Offices

HLI opened the London representative office in 2007 in an effort to secure a base in the financial market of London, where a number of global financial institutions are headquartered. The London representative office is responsible for identifying investment targets and building an asset management network in Europe. At the same time, the London office introduces the expertise of the advanced UK and European life insurance companies to the HLI headquarters which contributes to upgrading our domestic operation and establishing effective strategies for potential new markets.

HONG KONG

HONG KONG Representative Offices

HLI secured a foothold in Hong Kong for research of the financial industry and insurance market of ASEAN in 2013. Our representative office in Hong Kong, which is situated in the Central District where financial institutions are concentrated, is in charge of studying trends of ASEAN’s financial and insurance market as well as building a cooperative network of related institutions. Moreover, the Hong Kong office is making our overseas investment portfolio, which is heavy in US and European assets, more globally diverse by suggesting Asian investment options.